Hey Neighbor. New research suggests that employees who sign non-competes make 4.9% less than those who don’t and that new employees spend, on average, two seconds reading the seventh page of the contracts they sign.

Because they are so hard to enforce, non-competes are dismissed as corporate security theater by many white-collar workers. That may be fair, but they are correlated with things that matter.

If you’d rather not receive this newsletter, click here.

🍸 Let Us Buy Some Christmas Presents for You…. Upper Middle Research, our research platform, pays up to $300-an-hour for surveys. Join and defray the cost of all those gifts.

🥃 Eavesdrop on Would-Be Overlords. Want a byte-sized version of Hacker News? Try TLDR’s free daily newsletter. TLDR covers the most interesting tech, science, and coding news in just 5 minutes.

🚬 Join Our Favorite Trivia “League.” Try out Uncovered Shorts, Wall Street’s daily distraction. We’re planning to launch our own leaderboard and give out dumb prizes. It’s our New Year’s resolution.

→ Cruel Intentions, which served as a primer on sex and status for kids in the 1990s just as Les Liaisons Dangereuses was for Parisian starfuckers in the 1780s, is back – now on Prime [1]. The big twist in the new D.C.-set series is that Annie (Madame de Tourvel in the source material and Reese Witherspoon in the movie) is not merely virtuous; she’s the daughter of the vice president. As Trump’s billionaire cabinet assembles, the choices feel prescient.

→ The alleged assassination of UnitedHealthcare CEO Brian Thompson by UPenn grad, private school valedictorian, and handsome dude Luigi Mangione has inspired a mostly incoherent national conversation about healthcare costs and how best to season the rich, but a few elements of the discourse are worth considering:

The subtext of the coverage of Mangione’s educational background indicated disbelief that someone with radical, violent politics emerged from the Ivy League. But many have. Some worked in the White House.

Americans struggle to discern the difference between the Upper Upper Middle and the rich. Witness the attention paid to Thompson’s $1.5M mcmansion outside Minneapolis, a Rorschach test for those discussing wealth inequality. Some saw a castle. Others saw a house.

None of the political takes really took. Those posting #FreeLuigi seemed to have more in common financially than politically.

Borrow up to $800 to cover unexpected expenses!

Spotloan is a better way to borrow extra money when you need it. It’s not a payday loan. It’s an installment loan, which means you pay down the balance with each on-time payment. Borrow up to $1,500 (up to $800 for new and repeat borrowers, up to $1,500 for preferred customers with 10 or more loans). Then, pay Spotloan back a little at a time.

Spotloan let's you get money fast. Most people complete the application and find out if they're approved within minutes! Plus Spotloan can offer loans at up to half the cost other small-dollar lenders, payday companies, and pawn brokers... without the hidden fees!

Spotloan can help with all of life's emergency expenses, from hospital bills to car emergencies to a sick pet or a broken cell phone.

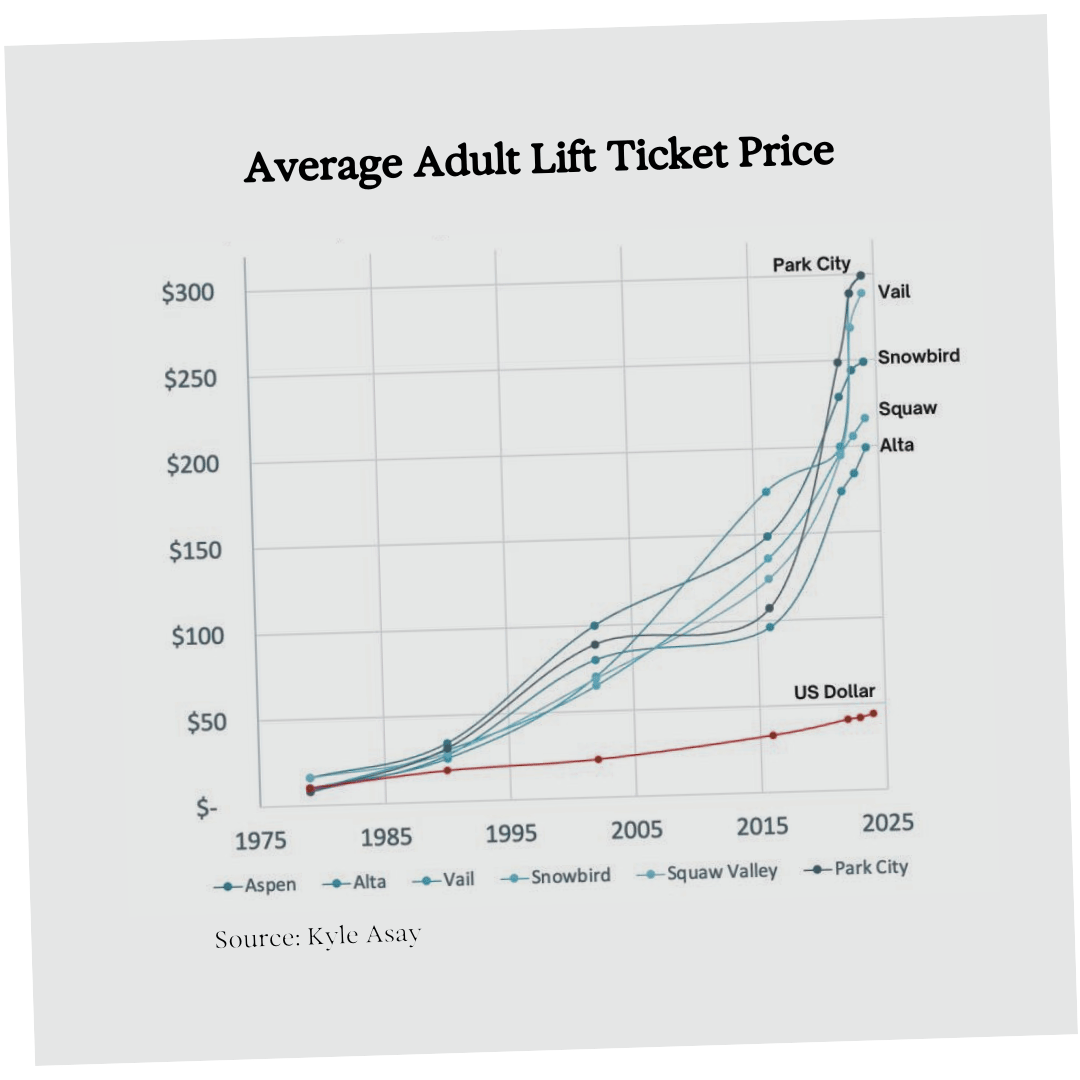

How skiing got away from us.

Ski season will be longer this year than last courtesy of the November storms that dumped feet of snow on Colorado and Vermont, but fewer Americans will go skiing. The numbers have been headed downhill since 2004. Many blame exorbitant lift ticket prices – and that’s part of it – but the real reason that no one skis (except people who ski) is the Cold War on casual skiers.

To be clear, skiing is expensive. Lift tickets have gondola-ed up 2,300% percent since 1979 against inflation of roughly 340%. But those are the $300 “walkup prices” paid by a skier buying a day pass with no discounts and there aren’t many of those. Effective prices are way lower thanks to a pricing model Vail Resorts adopted in 2008 when it introduced the EPIC Pass, a pre-sold $579 ticket covering seven days at five mountains in Colorado and Heavenly in California. That move lowered the effective price of lift tickets for people who bought early (Vail wouldn’t guarantee the price after April) while allowing Vail to mitigate the seasonality of its inflows and focus on reversing any losses in lift ticket income by driving huge gains in off-piste revenue – getting pass buyers into resort-owned hotels and restaurants. [2]

It took less than a decade for the EPIC pass, which now applies to as many as 60 mountains and costs $1500+, to become a $500M+ business. Other passes (notably the IKON) followed as other operators pivoted to serving fewer, higher-value customers willing to plan far in advance.

Ski-towners, who had benefited from local season pass competition in the 1990s, complain that the new passes forced them to pay a premium for access to far-away mountains, but the bigger problem is that penalizing late buyers and walkups dissuades casual, out-of-town blue square “gapers” from skiing at all. Pre-paid and membership-focused pricing models reward obsessives and dissuade dilettantes. [3]

This phenomenon – common from gyms to opera houses – is unusually pronounced when it comes to skiing. Country club memberships created a “pass” dynamic around golf a long time ago, pricing out folks who didn’t keep putters leaned against their sizable desks. But golf is mid-boom. Why the divergence in the popularity of the two whitest of white-collar sports?

The opportunity to dabble.

Post-Tiger and pre-pandemic, golf spent the 2010s bleeding players. But that trend set the sport up for success because it allowed cities to buy out struggling private clubs. There were over a hundred more muni courses in 2020 when the pandemic hit than there had been in 2000. This provided new players an on ramp and old players an easy way to pick up where they’d left off.

Skiing’s pandemic resurgence melted because few beginners had access to low-cost “municipal mountains.” In New York, which invests more than any other state in publicly owned slopes, there are only three major muni mounts: Gore, Whiteface, and Belleayre. Colorado has a handful, but most are laughable: Lee's Ski Hill in Ouray has a 75-foot vertical drop, making it just over 2% as vertical as of Vail.

This all suggests that skiing will likely continue to decline in popularity and that Vail Resorts will continue to rake. It also suggests that fewer and fewer American garages will have pairs of beaten-up old Rossignols leaned in the corner. No one skis (except people who ski).

→ Pinterest released its big prediction package for 2025 and there’s an unsurprising focus on tablescaping. The social platform for mason jarheads calls out three microtrends in particular:

Surrealism: People are leaning into the Dali of it all. This presumably accounts for the rise of Gohar World (basically Williams-Sonoma on acid). Pinterest also predicts a rise in weird cakes and the continuation of the “Rat Cake” trend, which feels related.

Rococo: Ornate for the sake of ornate, table settings that nod to the Regency Era and presumably inspire either overt formality or the opposite (the vibe here is arguably more subversive than aristocratic).

Pickles: Hell yeah. (READ MORE)

→ One of the interior design trends of the moment is the “Big Ceiling Light,” a pendant fixture meant to dominate a space. The problem with the trend is that big ceiling lights create a lot of glint on screens, making it hard to watch A.P. Bio on Netflix. As such, this trend isn’t particularly workable even though it jives with the aesthetics of our moment. Wither the chandelier? (READ MORE)

→ The Prince of Wales has a beard. The incoming VP has a beard. Pedro Pascal has at least two. Still a thing!

→ The Poursteady, a machine that allows high-end coffee shops to make drip coffee faster, is slowly spilling out across the country. That’s good news for bean-heads because it will mean less dependence on the big pot and more choice. It’s not good news for people in a hurry. (READ MORE)

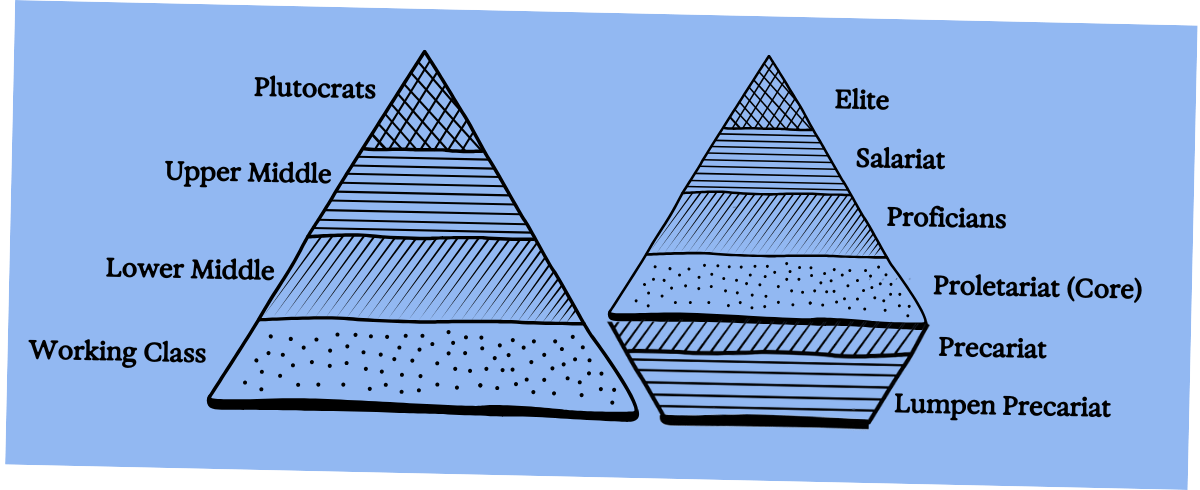

Several class border skirmishes broke out on Twitter this week as college professors identifying as “Working Class” were pilloried for cultural appropriation by proletarians uninterested in the academics’ paycheck-to-paycheck finances or the vagaries of tenure. Unsurprisingly, the “conversation” that ensued was marked by insults and performatively obtuse argumentation. No resolution was reached.

But, of course, not resolution could be reached because the participants in the debate (or w/e) were talking about two different things. The professors were talking about wealth and making a distinction between the Upper Middle and Lower Middle (there is no Middle Middle). The pseudo-Marxists were talking about status and making a distinction between “proficians,” those paid for their obscure areas expertise, and the proletariate. As such, they were discussing two different class structures.

Think of it as the pyramid versus the wobbly pyramid.

This is all to say that one involved in the “Academics are or aren’t working class” [4] discourse was precisely right or precisely wrong. But also… the professors should have known better. The idea that income – rather than income, status, and habitus – determines class identity is high school shit. The temptation to wrap oneself in Carhartt when it gets a bit too cold for tweed may be overwhelming, but that kind of layering never works.

→ A new study from Cerulli and Associates, which has figured out a surefire way to get media coverage, further refines previous Great Wealth Transfer estimates, suggesting that Millennials will inherit more than $45 trillion by 2048, with some $3.9T moving into their hands that year. Generation X will see annual inheritance levels peak in 2038 around $2T. (READ MORE)

→ Food prices are at high and the stock market just hit turbulence. An unscientific guess: This will lead to between 3% and 5% more holiday-related fights.

→ Post-election crypto newbs are having a fun week.

→ Hedge funds and private equity are trying to use the private wealth networks built out by large banks to reach double- and (some) single-digit millionaires, offering access to investments that would have previously been on the other side of a velvet rope. This is happening as wealthier investors tired of underperforming the S&P 500 pull their money, creating a cash crunch. The bet is that investors will be attracted by the prestige of previously inaccessible investments and not look to hard at the performance metrics. (READ MORE)

[1] For the record, the show is quite bad whereas both Cruel Intentions the movie and Dangerous Liaisons were quite good (Michelle Pfeiffer, yowza) so go watch those.

[2] It’s worth noting that pre-selling tickets also mitigates risks associated with inclement or warm weather. In other words, it’s a climate change play as well as a revenue smoothing play.

[3] Dilettantism always gets a bad name, but it’s actually one of the great luxuries of modern life. Being good at stuff is fun, but it’s best to order off life’s tasting menu.

[4] FWIW, the creation of a high-status, low-income class (I think of them as “The Romantics) is a work in progress in America – thanks financialization – but old hat in Europe, where this week’s dumb internet debate wouldn’t really make much sense. Academics in Europe are solidly Middle Class. But one might argue that’s because Europe has the Middle Middle that the U.S. lacks.